Introduction

In the current scenario of retail and small businesses, the question that often arises is whether small shops or SMEs have the requirement for cash drawers. Some may argue that cash drawers are becoming obsolete with the rise of digital transactions and cashless payments. However, digging deeper into small businesses’s needs reveals that these essential tools are far from irrelevant. Cash drawers crucial in ensuring smooth operations, financial accuracy, and customer satisfaction for small businesses.

What are cash drawers?

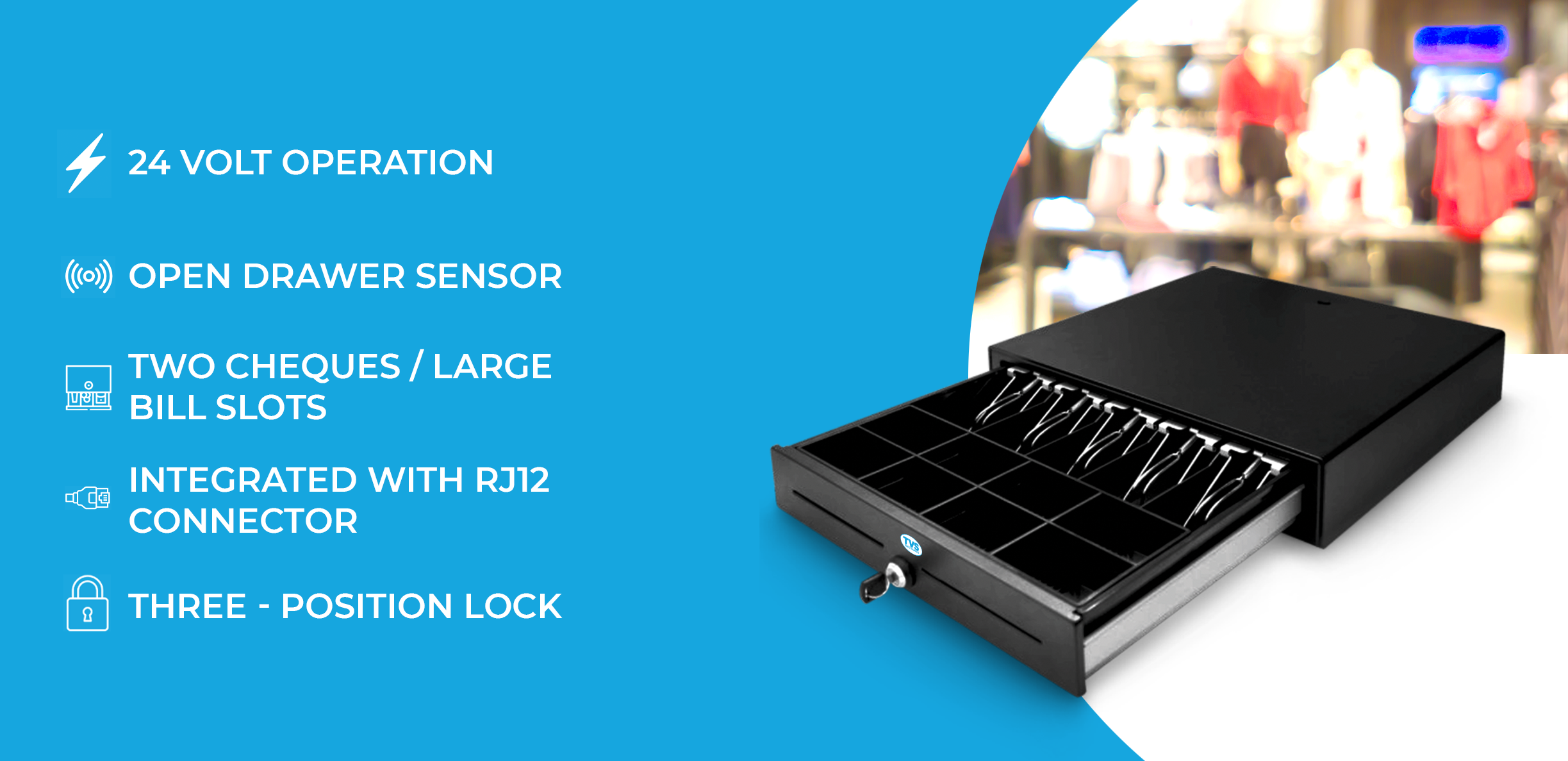

Cash drawers serve as secure repositories for physical currency and coins. Typically integrated into point-of-sale (POS) systems, they are designed to organize and safeguard cash during transactions, ensuring accuracy and efficiency in payment handling. These drawers feature compartments of varying sizes to accommodate different denominations of currency and sections for coins.

Cash drawers provide security and often come with connectivity options that allow them to sync seamlessly with POS systems and receipt printers. This integration enhances the overall efficiency of cash-handling processes in retail, hospitality, and other industries where cash transactions remain a prevalent mode of payment.

Benefits of cash drawers:

1. Customer preference and experience: Small shops and SMEs cater to diverse customer demographics; not everyone is comfortable or accustomed to digital transactions, and a significant portion of customers still prefer to pay in cash. By having cash drawers, businesses can accommodate all customers. These drawers simplify transactions by seamlessly integrating with business and POS software, resulting in improved point-of-sale performance. This operational proficiency enables staff to provide better customer service, facilitating smooth checkouts for customers and enhancing their overall experience.

2. Transaction speed and efficiency: Cash transactions are often quicker and more efficient than electronic payments, especially for small purchases. Cash drawers allow businesses to handle transactions swiftly, reducing customer wait times. This efficiency is vital in creating a positive shopping experience, as customers appreciate a smooth and prompt checkouts.

3. Cash management and security: Cash drawers help maintain accurate financial records and ensure accountability in cash transactions. Manual cash handling without a secure storage system can lead to errors, discrepancies, or potential theft. Cash drawers provide a controlled environment for managing cash, reducing the risk of mistakes and enhancing overall financial accuracy.

4. Durability: POS cash drawers are designed to offer durability and versatility across various business settings. POS machine manufacturers provide a range of high-quality, compact cash drawers suitable for diverse store environments. These drawers boast robust construction, ensuring longevity with millions of operations.

5. Backup in case of technical glitches: Despite technological advancements, technical glitches or network outages can still occur, disrupting electronic payment systems. In such situations, having a cash drawer as a backup allows small businesses to continue operating smoothly. This ensures that sales are not hindered by unforeseen technical issues, safeguarding the business from potential revenue loss during downtimes.

6. Trust and Credibility: For many customers, cash drawer provides a sense of security and credibility. While digital transactions are generally secure, some customers may still have reservations or concerns about the safety of their financial information. Cash transactions, facilitated by cash drawers, provide a tangible and transparent payment method, contributing to the business’s overall trustworthiness in the eyes of the customer.

7. Flexibility: Cash transactions offer flexibility that digital payments may lack. Small businesses often face tight profit margins and may be more inclined to offer discounts or negotiate prices for cash transactions. Cash drawers empower businesses to be flexible in pricing strategies, allowing them to cater to various customer needs and potentially attract a broader customer base.

8. Ease of installation and adaptability: Transitioning to cash drawers, whether for shops or small businesses, is seamless due to their user-friendly and adaptable nature. The operations are easy to navigate, making them straightforward to learn and master. Including additional features enhances the simplicity and organization of the point-of-sale process. Cash drawers are adaptable tools that accommodate these varied business models, providing the necessary infrastructure for efficient cash handling.

Conclusion:

Investing in a reliable cash drawer is a wise decision for small businesses looking to thrive in a competitive market. It not only contributes to the overall efficiency and professionalism of the business, but also ensures that it remains adaptable to the diverse needs and preferences of its customer base. In a world where customer satisfaction and financial accuracy are paramount, cash drawers are vital assets for the sustained growth and success of small shops and SMEs.

TVS Electronics provides cash drawers for the modern business environment with all the latest features and innovations catering to small shops and SMEs.